See the status of your submitted forms

Once an employee’s completed WOTC forms have been completed and sent to the IRS, you will be able to track and monitor their eligibility status in CanopyWS. Knowing their status lets you keep tabs on possible tax refunds!

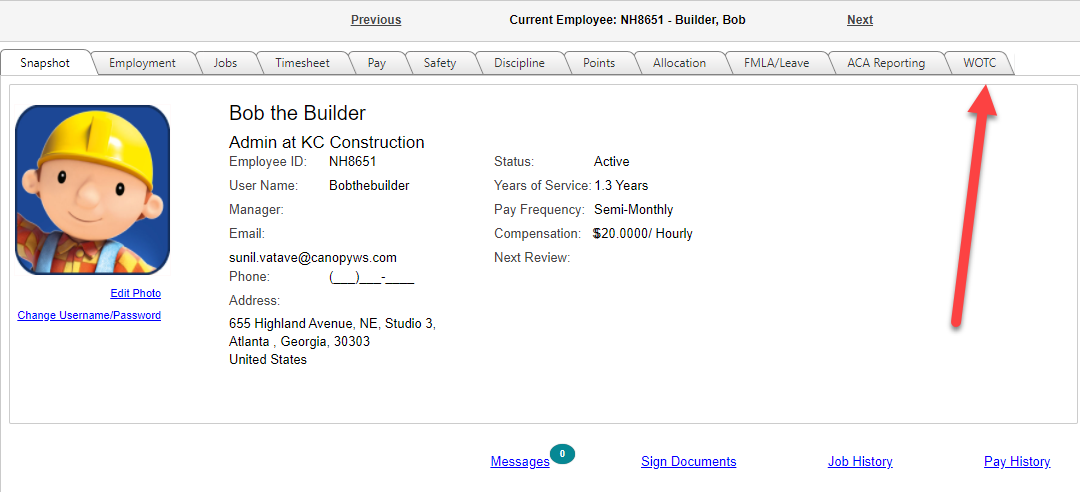

Each employee will have a WOTC page, which can be accessed from an employee’s Snapshot, or by clicking the link in the Employee tab.

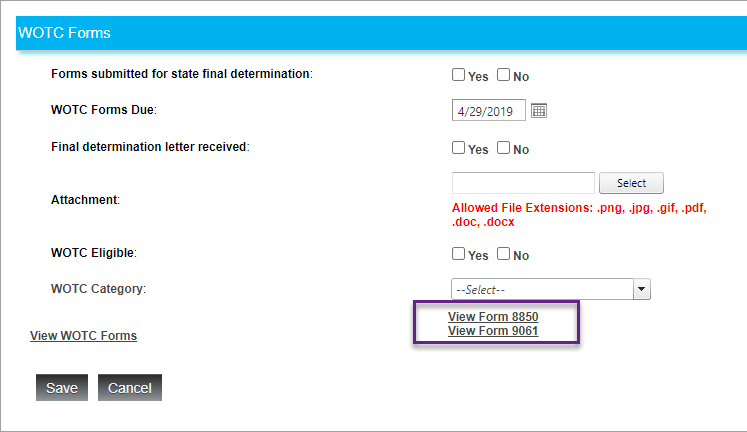

Clicking it will take you to that employee’s WOTC page. From this page, you can view their completed forms, as well as fill in the information provided by the IRS regarding their eligibility.

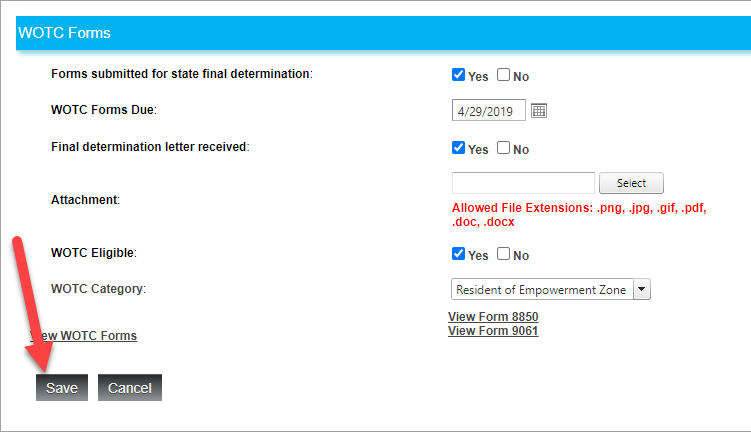

In the screenshot below, I have edited the page to indicate that this employee’s forms were submitted, and that that they were determined to be eligible (as a resident of an empowerment zone.) Click Save to confirm these changes.

The WOTC tab can be toggled on and off for administrators by editing the role visibility. See our articles on roles for more information!