Submitting WOTC data during onboarding

Worker Opportunity Tax Credit forms, once filled out, can be submitted to the IRS for tax refunds. Depending on certain attributes, such as SNAP benefits or county location, your employee might be eligible and save the company money in the long run. So it would be beneficial to have these forms filled out during the onboarding process.

The following steps demonstrate how a user can fill out and sign Worker Opportunity Tax Credit (WOTC) forms via CanopyWS onboarding.

Instructions

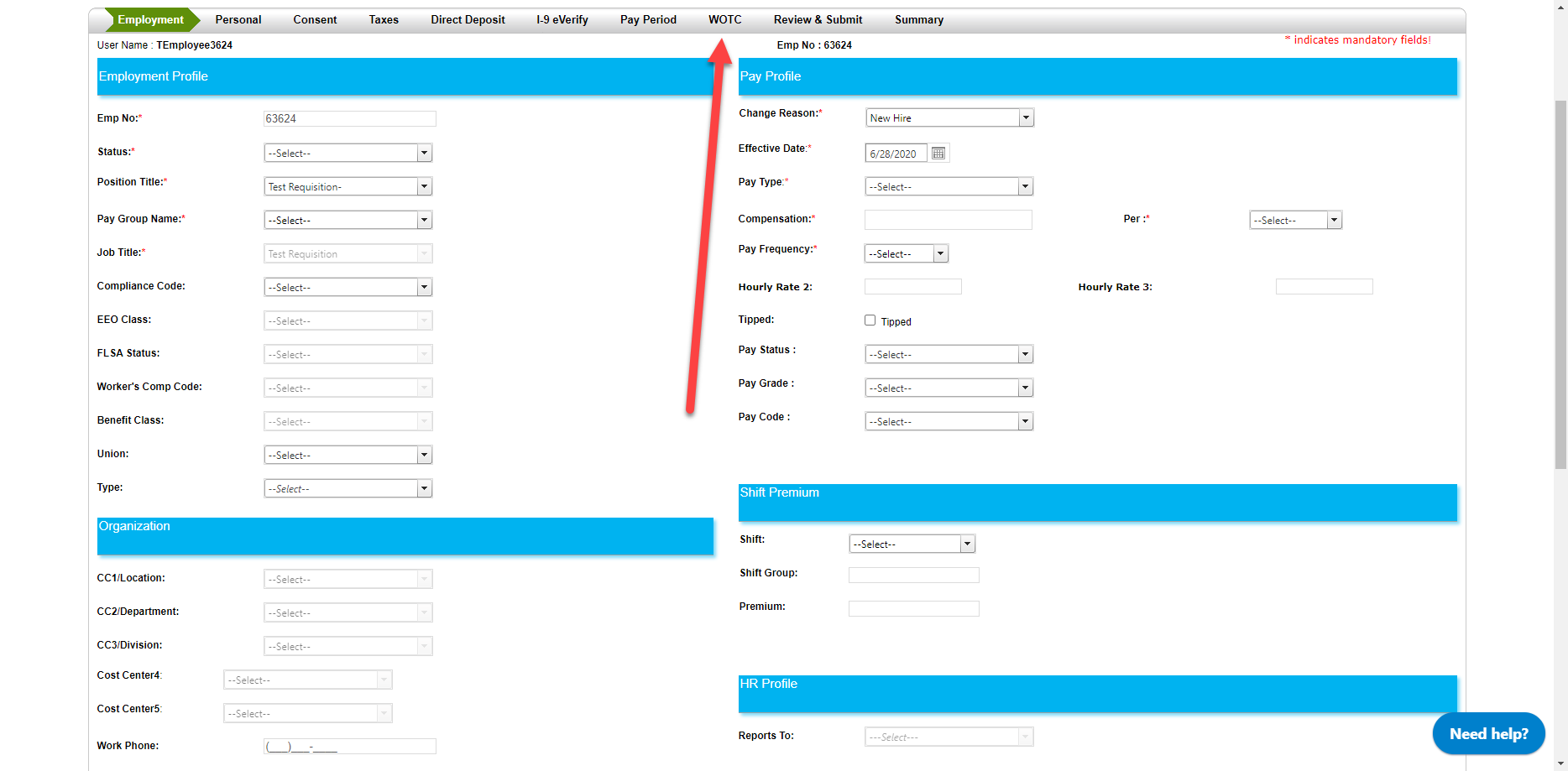

From the new hire tabs, you will see a WOTC tab. You can either fill out the preceding tabs first, but for this exercise, we will navigate to the WOTC tab directly.

-

Click on the WOTC tab.

-

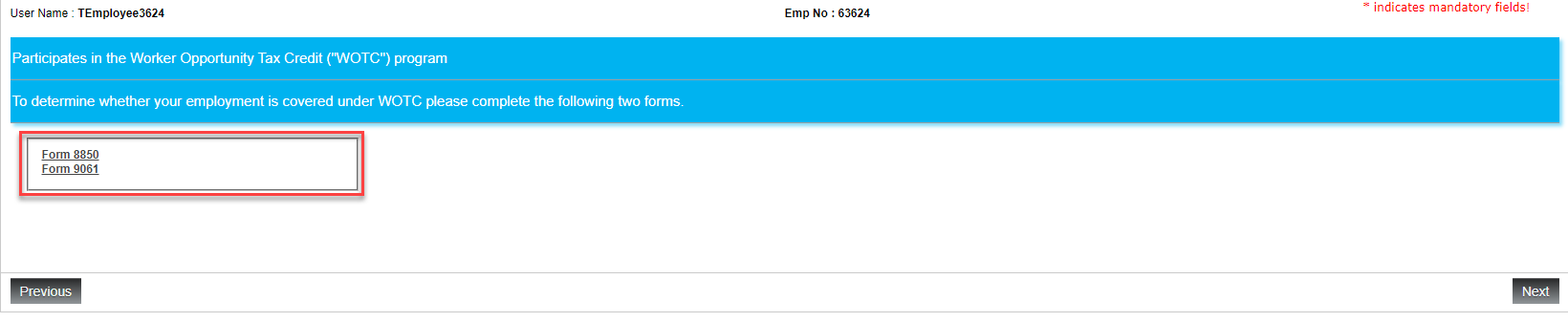

There will be two editable PDF files to fill out, forms 8850 and 9061.

-

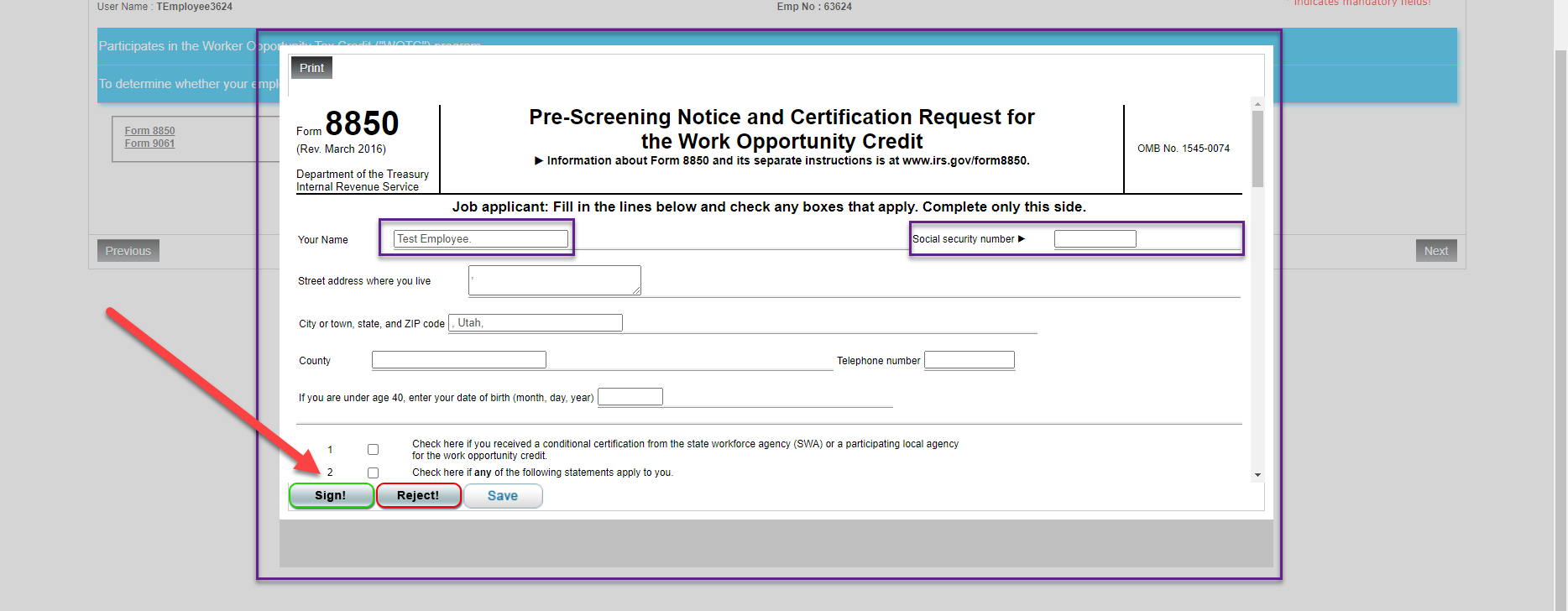

Each form can be clicked and filled out in their respective pop-up window. When you are done filling them out, click the green Sign button and confirm that the information is correct.

-png.png)

-

Once the forms have been signed, viewing them again will show the e-signature at the bottom. If you believe you have made a mistake, then you can click the Un-sign button to start over.

-png.png)

-

You may now continue with the rest of the new hire tabs.

This method is the same whether you are filling out the onboarding forms yourself (Self Service On-Boarding) or as an administrator for a new hire (Add New Hire). However, the tab appearance may change.